Does Insurance Cover Laser Eye Surgery Cost?

Prathyusha Itikarlapalli

- Content Writer

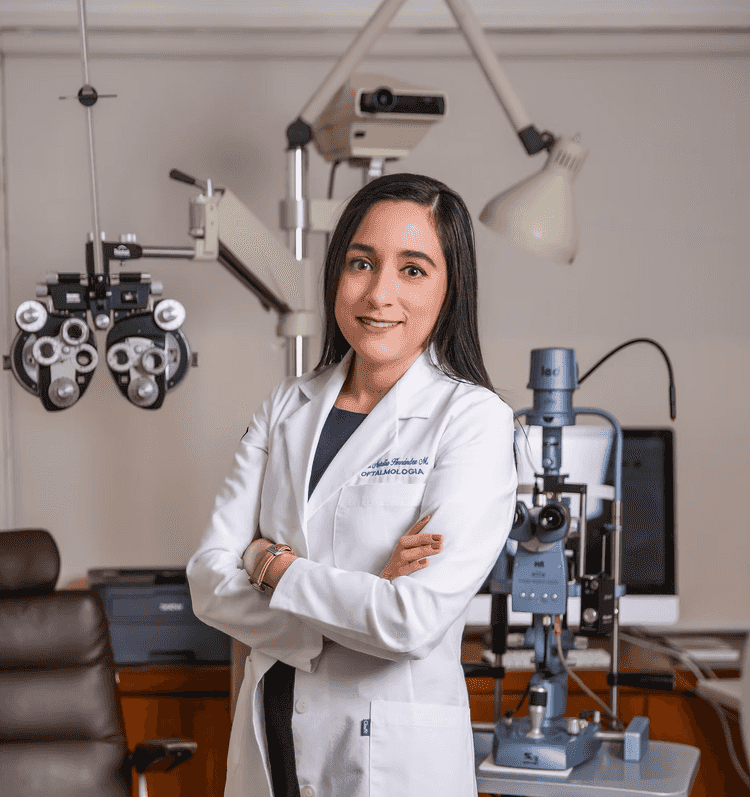

Dr. Natalia Hernandez Martinez

- Reviewed by

Table of contents

- Why Get Laser Eye Surgery?

- How Much Does Laser Eye Surgery Cost?

- Does Health Insurance Cover Laser Eye Surgery?

- Which Insurance Plans Include Laser Eye Surgery Benefits?

- What Are the Best Insurance Options for Laser Eye Surgery Coverage?

- How Do I Check Whether My Insurance Covers Laser Eye Surgery?

- Does Vision Insurance Cover Laser Eye Surgery?

- How to Pay for Laser Eye Surgery When Uninsured?

- Is Laser Eye Surgery Still Worth the Price Without Insurance?

Key Takeaways

- Laser eye surgeries like SMILE, PRK, and LASIK cost between $1,500 and $5,000, with the exact cost varying by the technology, clinic, and location you choose. Most standard and private health insurance plans do not cover the laser eye surgery cost because it is considered elective. In rare cases, insurance may cover surgery costs when it's performed to correct refractive errors for medical reasons, or following eye surgery.

- Vision insurance plans such as Aetna Vision, Blue Cross Blue Shield, Humana, Vision Service Plan, Cigna Vision, United Healthcare, and EyeMed Vision Care offer discounted prices for laser eye surgeries. Cost reduction ranges from 15% to 50%, depending on the insurance plan. Some also offer financing options and allow you to use pre-tax funds from HSA and FSA.

- Terms vary by plan, with some requiring pre-authorization, meeting credit eligibility, and choosing an in-network provider. Discussing the insurance options and plan details with the ophthalmologist and insurance provider in advance is mandatory.

Why Get Laser Eye Surgery?

Laser eye surgeries are a modern approach to dealing with vision problems. It reduces your dependence on glasses for conditions such as nearsightedness, farsightedness, and astigmatism. Candidates with blurry vision due to corneal issues require glasses or contact lenses to achieve clear vision and a better quality of life. Laser eye surgeries, including LASIK, PRK, and SMILE, cut your reliance on contact lenses and glasses. Not just that, getting laser eye surgery will

- Help you achieve a more convenient lifestyle.

- Improves confidence and quality of living.

- Cuts the long-term costs of vision correction aids.

- Help you achieve your professional goals (especially for sportspeople).

Popular laser eye surgeries aim to reshape the cornea for better vision and to correct refractive errors. While LASIK, SMILE, and PRK are the common laser eye surgical procedures, the techniques and recovery vary slightly.

- LASIK: Ophthalmologists reshape the cornea by creating a thin corneal flap, lifting it, and using the excimer laser to reshape the cornea. The falp is repositioned to heal, and you will gain better eyesight.[1]

- SMILE: Ophthalmologists use femtosecond lasers to create a lenticule (tiny lens-shaped piece) within the cornea. They remove this lenticule through a tiny incision, reshaping the cornea to give you clear vision.[2]

- PRK: Ophthalmologists remove the cornea's outer layer so the excimer lasers can gain access to the inner corneal tissue to reshape it. They place a special bandage contact lens to aid in healing.[3]

How Much Does Laser Eye Surgery Cost?

Laser eye surgery in the United States costs between $1,500 and $5,000 per eye. The exact cost varies by surgery type, the technology used, and the location where you plan to have the procedure. LASIK and SMILE cost around $2,000, and PRK costs around $1,800.

Does Health Insurance Cover Laser Eye Surgery?

Most health insurance plans do not offer coverage for the costs of laser eye surgery. In general, insurance applies to medically necessary surgical procedures. Laser eye surgeries are considered an elective procedure. Most health insurance plans consider laser eye surgery elective because it treats problems that aren’t life-threatening and are already managed with glasses or contact lenses. From an insurance perspective, laser eye surgery is intended to improve convenience and quality of life. It's not for a basic emergency, and hence insurance policies classify it as a cosmetic procedure. In rare cases, some candidates might acquire coverage depending on the other conditions. Here are a few instances when vision correction becomes necessary and when insurance may apply.

- You require laser eye surgery to correct the refractive errors following an eye surgery, or those that occurred due to an injury.

- You cannot wear contact lenses or glasses due to physical limitations due to allergies, or dry eyes.

- You suffer from severe vision impairment, or there exists a severe anisometropia (large difference in prescription of both eyes), and glasses or contact lenses alone cannot satisfy your vision needs.

- You are in a job role where wearing glasses or contact lenses does not satisfy the need. This particularly applies to firefighters, pilots, or military personnel.

Which Insurance Plans Include Laser Eye Surgery Benefits?

While most standard and private health insurance plans do not cover laser eye surgery costs, here are some popular vision insurance plans that offer better discount rates.

Aetna Vision

The Aetna Vision insurance plan is one of the popularly chosen vision insurance plans. The plans cover routine eye examinations and eyewear, but typically do not cover laser eye surgery. However, they offer significant discounts on treatment charges, typically 15-50%. However, you should schedule the surgery through the network providers to qualify for the discounted prices.

Blue Cross Blue Shield Insurance

Blue Cross Blue Shield (BCBS) is one of the largest insurance networks in the United States. It spans around 33 individual local insurance companies working as a federation. So the plans, offerings, and costs typically vary by state. Most BCBS plans are designed to cover eye care examinations and eyewear. So if you ask us, Does Blue Cross Blue Shield insurance cover laser eye surgery? The answer is a partial yes: BCBS does not directly cover the surgery costs, but you can expect discounted rates of 15-50%. However, you should check with your local BCBS provider to confirm the exact coverage percentage and the basic requirements.

Cigna Vision

Cigna Vision is part of the US major insurance provider, Cigna Insurance, and covers vision alongside dental, medical, and other prescription drugs. It has one of the largest provider networks, so patients have a wider range of in-network hospitals and doctors to choose from. Regarding Cigna Vision's current coverage for laser eye surgery, you cannot expect complete coverage. While the plan does not offer coverage, you can expect discounted rates of 15-25%. Not just that, you can also use the funds from your employer's FSA/HSA program to pay the discounted rates.

VSP (Vision Service Plan) Care

It is one of the largest eye care insurance programs in the United States with a large group of in-network providers. Like any other insurance plan, the VSP does not offer coverage. But you can expect discounted rates of around 15-30% by choosing the in-network providers. Alternatively, you may also use the pre-tax funds of your employer-sponsored HSAs and FSAs.

EyeMed Vision Care

The EyeMed vision care insurance plan, like most insurance plans, does not cover laser eye surgeries. It offers considerable discounts and better financing options. You can expect around 15% off standard laser eye surgery prices.

Humana Vision Plan

The Humana Vision insurance plan offers a wider network of providers covering routine eye examinations and eyewear. But the coverage does not apply to laser eye surgeries. Instead, you can expect price discounts of up to 15% by choosing the in-network providers.

United Healthcare Vision

United Healthcare Vision, like other insurance providers, does not cover laser eye surgery. Instead, you can expect discounted prices with 20-35% off on the treatment costs. You may pay for the rest costs of surgery out of pocket or use funds from your HSA and FSA.

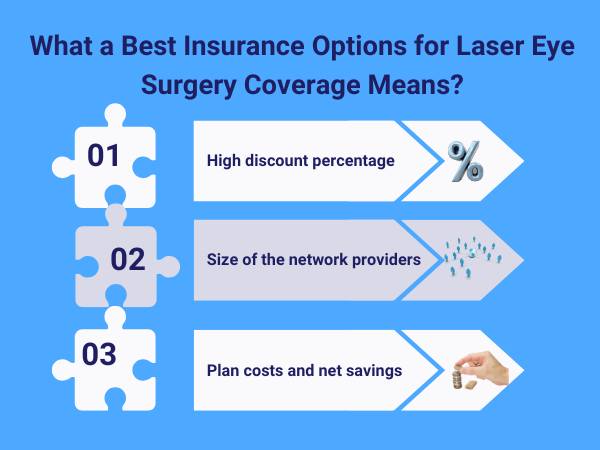

What Are the Best Insurance Options for Laser Eye Surgery Coverage?

While numerous private insurance plans offer discounted rates for laser eye surgery, finding the best one can be difficult. You should know the following before selecting the best-suited insurance option.

- Compare discount percentages

- Check out the size of the network providers

- Insurance plan costs and net savings

Generally, an insurance plan with a broader provider network and higher discounts is an ideal pick. You will have a wider choice of doctors to select from while availing significant cost savings. To do this, review your insurance plan documents and request price quotes from providers. In addition, you should check eligibility through the insurer's portals.

How Do I Check Whether My Insurance Covers Laser Eye Surgery?

In order to check if your insurance covers laser eye surgery, you should:

- Carefully review your insurance plan and contact the insurer directly.

- Talk to your ophthalmologist or the patient coordinator, or the billing team at the eye hospital.

Below, we list the questions you should ask your doctor and insurer before planning your treatment.

|

Questions to ask the doctor |

Questions to ask the ophthalmologist |

|

Which laser eye surgery am I eligible for? |

Does my insurance plan cover laser eye surgery, or offer discounted rates? |

|

Can I get a price quote with the total treatment cost and a clear breakdown? |

Do I qualify for discounts, partner clinic pricing, or reimbursements? |

|

Do you offer payment plans or financing options? |

Do I need pre-authorization for insurance approval? |

|

What is the re-treatment or enhancement policy in case I notice vision changes later? |

Can I use FSA or HSA funds for the treatment? |

|

Are post-op medicines covered? |

Does Vision Insurance Cover Laser Eye Surgery?

In general, vision insurance covers the routine eye care examinations and other costs of glasses and contact lenses. The good news is that even when laser eye surgery isn’t fully covered, many vision insurance plans still offer cost-saving benefits that can reduce your out-of-pocket costs. These are not direct coverage benefits, but they can make the procedure more affordable.

- Partial reimbursements: Some vision insurance plans provide partial reimbursement, allowing you to receive a partial coverage amount right after the laser eye surgery.

- Discount programs via providers: Some vision insurance plans offer discounted rates for laser eye surgery when you choose providers in the plan's network.

- Vision plan partnerships: The partnership plans may not directly reimburse or pay surgical treatment bills, but they may cover surgeon fees, consultations, diagnostic tests, and pre-op examinations. These can still be a considerable saving on the overall treatment costs.

How To Pay for Laser Eye Surgery When Uninsured?

Since laser eye surgeries aren’t generally covered by standard health insurance, we outlined the other ways you may choose for affordability. Most patients choose either for:

- Direct payment to provider: You will pay the surgery fees and other treatment-related fees directly to the eye hospital. You will gain access to better discounted self-pay rates, limited-time offers, or package pricing. However, these vary with the provider, and not every provider offers the same deals. These often vary with seasonal promotions, availability, location, and provider.

- Monthly payment plans: Some providers and third-party insurers offer them. In short, the entire payable treatment amount is split into small payable installments. You can select the payment plan that best suits your finances. While approval will be based on your creditworthiness and basic personal details, you will save considerably by paying within the interest-free period. Not paying within the low- or zero-interest period may result in higher interest rates as specified by the provider.

- Financing options: These allow monthly payments either through the provider or third-party financing companies. You will choose a plan based on your financial convenience, apply for it, and wait for approval. Once approved, the total treatment cost is split into small, payable monthly installments. Some plans also offer low or zero-interest rates if the balance is paid within a specified time frame.

- Employer-based FSA and HSA: These options are special health accounts that let you put tax-free money into them instead of using your salary. You can use these pre-tax funds for surgery and other medical-related expenses. The approach reduces your overall treatment costs.

Is Laser Eye Surgery Still Worth the Price, Even if Insurance Does Not Cover It?

Laser eye surgery can still be worth the price, even when insurance does not cover it. Although it involves an upfront cost, the benefits are long-lasting and often reduce or eliminate the need for glasses and contact lenses. Over time, you will notice considerable savings on routine eye care expenses while gaining clearer vision, daily convenience, and greater lifestyle freedom. For those who qualify, the long-term value often outweighs the initial investment.

Final Word!

Does insurance cover laser eye surgery? In most cases, the answer is no, but that doesn’t mean patients are left without options. While standard health insurance rarely covers elective vision correction, many vision plans offer discounts, and flexible payment tools like FSAs, HSAs, and monthly financing can make treatment more manageable. By understanding what your plan allows and how to use available benefits, you can make an informed decision and plan your laser eye surgery with confidence.

Not sure how your insurance applies to laser eye surgery? Sign up with Envoy Health to receive clear guidance on coverage options, available discounts, and safe treatment pathways so that you can move forward with confidence, not guesswork.

References

Disclaimer

The information in this article is for educational purposes only and does not replace medical advice. Always consult your doctor before starting any treatments.

Clinical trials, research studies, conducted at medical schools and universities are among the top places where you can get free or deeply discounted laser eye surgery. Getting free laser eye surgery is quite rare in the United States. Either you have to pay out of pocket, avail of discounted prices, or opt for financing to avoid high costs.

The truth is that many employer-sponsored insurance plans do not fully cover laser eye surgery. However, you can expect employee benefit packages with discounted prices, partial price reimbursement. Note that these vary with the employer and insurance plan type. You will have to review your summary of benefits and contact your employer to know the exact benefits.

Yes, there are price discount programs and insurance add-ons for laser eye surgery. But you cannot expect complete coverage for treatment costs. While many vision insurance plans offer these benefits, they only reduce what you actually pay.

So, we partner with the premier healthcare facilities!

Send me the list