Is Cataract Surgery Covered by Insurance, or Do You Pay Out of Pocket? Here’s everything you need to know

Prathyusha Itikarlapalli

- Content Writer

Dr. Natalia Hernandez Martinez

- Reviewed by

Key takeaways

- Cataract eye surgery is covered by medical insurance, and not vision plans. Health insurances, such as Medicare, Medicaid, and other private insurers, typically cover the cost of standard cataract surgery with a basic intraocular lens (IOL), as it's considered a medically necessary procedure.

- Coverage does not mean zero cost; out-of-pocket expenses still apply. While insurance may significantly reduce the financial burden (up to 80% in some cases), patients still need to pay for non-covered items, such as premium IOLs, pre- and post-op visits, anesthesia, or out-of-network provider fees.

- Not all plans are equal; know what to ask your insurer. Coverage, deductibles, and lens options vary among Medicare, Medicaid, and private plans, such as Aetna, Cigna, or Blue Cross. Always verify in-network providers, prior authorization requirements, and what's included in your plan before scheduling surgery.

An Overview of Cataracts and Surgical Removal

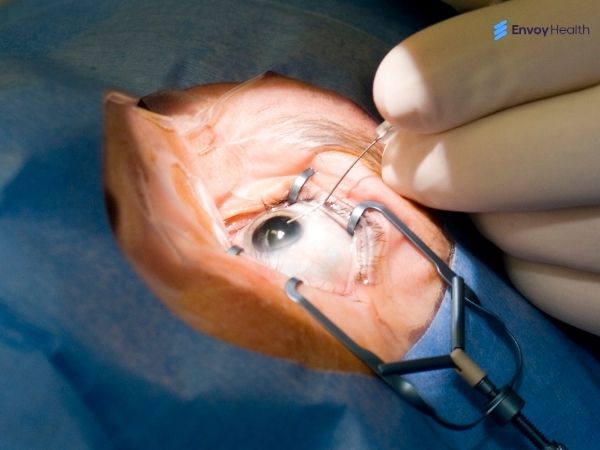

Around 3.8 million Americans undergo cataract surgeries each year. In fact, it’s one of the most commonly performed surgical eye procedures.[1] While a clouded cataract lens blocks light, causing blurry vision in one eye, it does significantly impact vision and daily life. The procedure involves the extraction of the dense, clouded cataract lens and replacing it with a clear intraocular lens (IOL). While the procedure is straightforward, with a very short recovery time, many patients experience clear eyesight and an improved quality of life following surgery.

Understanding Cataract Surgery Costs

On average, ophthalmologists in the United States charge between $3,000 and $7,000 per eye for cataract surgery. Planning for cataract surgery costs means considering the costs for the procedure (surgeon and facility fees), IOL, anesthesia, and pre- and post-surgical eye check-ups. Note that the cost of cataract surgery varies with factors, including the technology used, the clinic's location, the doctor's expertise, and the patient's insurance coverage. While insurance coverage doesn’t make the surgery entirely free, a suitable plan can reduce your out-of-pocket expenses by up to 80%. With regard to insurance, a few immediate questions that patients ask us are, “Is it the health insurance”?, “What insurance covers cataract surgery?” Worry not, as we discussed this in the upcoming section.

Is Cataract Surgery Covered by Medical Insurance or Vision Insurance?

Cataract surgery is covered by medical insurance. Most vision insurance plans cover routine eye check-ups, particularly for individuals who rely heavily on corrective lenses. In fact, they are ideal for individuals who suffer from eye-related issues and require frequent changes of corrective lenses.[2] So, if you ask us, “Is cataract surgery covered by vision insurance?” the answer is No!

On the other hand, health insurance programs like Medicaid or Medicare consider cataract surgery a medically necessary procedure. They offer considerable coverage, reducing your financial burden while you improve your vision. So, if you ask us, does medical insurance cover all types of eye surgery, the answer is no. We discussed this in detail below.

Is Eye Surgery Covered by Medical Insurance?

Health insurance, like Medicaid and Medicare, covers eye surgery costs in medically necessary cases. Corrective eye surgeries such as LASIK, refractive lens exchange, or PRK are not covered. While cataract is a medically necessary procedure, Medicare Part B covers the cataract surgery with standard IOLs, along with a pair of eyeglasses with standard frames or contact lenses. Please note that insurance coverage applies to both traditional and laser cataract surgery costs. However, you will need to pay out of pocket in case you require premium IOLs, such as multifocal or toric lenses.[3] Further, note that Medicare applies when the cataracts are too dense, and individuals experience severe vision problems. We answered a few frequently asked questions.

Is Laser Cataract Surgery Covered by Insurance?

The insurance coverage for laser cataract surgery typically depends on the plan you choose. Most private insurance providers consider laser cataract surgery a premium or upgraded version of traditional cataract surgery. While you can expect complete coverage for the standard procedure, you need to pay some amount out-of-pocket for laser cataract surgery. Your expenses typically vary depending on the provider and your individual needs. The individual needs here refer to your eye conditions and vision requirements. Suppose you suffer from astigmatism and need a toric lens, which is not covered by the insurance, and you will pay for it as a direct cost. While we mentioned toric IOLs, this also applies to other premium cataract eye surgery IOLs.

Why Is Laser Cataract Surgery Not Covered by Insurance?

Private insurance and Medicare consider traditional cataract surgery sufficient to retain vision. While laser cataract surgery offers precision, the results of traditional cataract surgery are no less effective. As a result, the insurance providers consider it an elective beyond a medical necessity. Furthermore, in most cases, laser cataract surgery is associated with premium IOLs, whereas a basic monofocal IOL doesn’t require laser assistance. Both of these can add to the overall costs.

Which Part of Cataract Surgery Is Not Covered by Insurance?

The premium IOLs required to replace the cataract lens are not covered as part of standard insurance plans. Most health insurance plans, including government-funded Medicare (Part B) and Medicaid, cover the surgical costs, standard monofocal IOL, and a pair of eyeglasses or contact lenses. This varies with your insurance plan. It is always recommended to discuss in detail with your healthcare provider and insurance provider regarding the insurance inclusions and your share of expenses.

More people are undergoing cataract surgery these days, thanks to advancements in technology and its success rate. As more patients opt for surgery, so too are more insurance options emerging. However, with so many plans available, it’s easy to feel overwhelmed. So, we’ve made it simple by breaking down which insurance works best for cataract surgery.

So, What’s the Best Insurance for Cataract Surgery?

The best insurance for cataract surgery depends on your age and healthcare needs. The government health insurance program Medicare offers stronger coverage for individuals aged 65 and above. However, younger individuals can opt for various private insurance plans tailored to their specific needs. We elaborated on each one below.

Medicare Cataract Surgery Coverage

Candidates aged 65 years and above are eligible for this federally funded health insurance program.[4] Cataract eye surgery is covered by Medicare Part B, which typically covers the costs of the surgical procedure and standard IOL implantation. While this covers 80% of the deductible, you are responsible for the remaining 20% of the costs. So, the average cost of cataract surgery with Medicare is around $600, saving you significantly from the original cost of $3,000. Please note that this Medicare coverage does not cover advanced IOLs or other premium upgrades. The potential out-of-pocket expenses include the post-op medicines and necessities. More importantly, cataract coverage with Medicare applies to medically necessary cases, which means the early-stage cataracts are not covered.

Medicaid Cataract Surgery Coverage

While Medicaid is specifically for low-income groups in the US, the program covers cataract surgery costs with a standard IOL. This can significantly reduce costs, but the amount of out-of-pocket expenses varies by state. Further, patients suffer from longer wait periods and are limited in the choices of IOL. The premium for IOLs, as well as pre- and post-op expenses, would be an added burden with this insurance option.

Blue Cross Blue Shield Cataract Surgery Coverage

The Blue Cross Blue Shield (BCBS) insurance plan, being a private one, also offers Medicare Advantage plans. The Federal Blue Cross Blue Shield cataract surgery coverage applies to cataract surgical procedures along with a standard IOL. The premium IOLs, such as toric or multifocal lenses, are not covered, and you will need to pay for them out of pocket. While these plans cover the cataract surgery costs significantly, the copays and deductibles vary considerably with the healthcare provider and the state you choose for treatment. Since the BCBS plans also offer Medicare Advantage plans, seniors seeking an added advantage of a flexible choice of providers can opt for this option. The advantages of Blue Cross Blue Shield cataract surgery coverage for seniors vary significantly with the plan. It's crucial to review the plan documents carefully to get the best out of it.

Aetna Cataract Surgery Coverage

The Aetna healthcare insurance offers coverage for medically necessary cataract surgeries. While Aetna plans vary in terms of basic terms and conditions, the best part is that a few of them cover advanced lens options. Furthermore, some of Aetna’s advantage plans also cover routine eye examinations and glasses or contact lenses (to a limited extent). However, the percentage of coverage varies depending on the service provider chosen. You should choose among the in-network ophthalmologists or eye hospitals to avail a better coverage.[5]

Cigna Cataract Surgery Coverage

Various Cigna insurance plans cover cataract surgery costs with varying percentages of coverage. While most of them cover the surgery costs along with standard lenses, a few also cover the diagnostic tests. However, like many other insurance providers, Cigna does not cover the premium lens options. Further, the coverage applies only to medically necessary cataract patients. Note that Cigna coverage for cataract surgery comes with some amount of deductibles, copays, and coinsurance.

Humana Cataract Surgery Coverage

The Humana insurance coverage works similarly to many other insurance plans. It offers coverage for cataract surgery along with a standard IOL. Furthermore, patients need to choose among the network of mentioned providers to obtain maximum coverage. Additionally, prior authorization is a mandatory requirement, meaning you need to obtain pre-authorization from Humana authorities in order to get it covered.

Probable Out-of-Pocket Expenses for Cataract Surgery

The government funds Medicare, Medicaid, and other private insurance providers, such as Humana, Cigna, Aetna, and Blue Cross Blue Shield, which offer coverage for cataract surgical procedures and a standard IOL. However, you will need to pay for premium lens choices out of pocket. Additionally, here is a list of a few treatment-related expenses that you will need to pay directly.

- Facility fees (in case you choose an out-of-network doctor)

- Pre-and post-op consultations and eye tests

- Anaesthesia costs

- Premium eyewear with designer frames

In addition to treatment-related expenses, you should also plan for deductibles, coinsurance, and copays. The amount typically varies among providers. Before scheduling your cataract surgery, ask your insurance provider the following questions.

- Is cataract surgery covered as part of insurance?

- Is laser cataract surgery covered as part of insurance?

- Do they cover premium IOLs?

- How much would the coverage be?

- Should I choose an in-network provider?

- What are the prior-authorization requirements?

- What are the additional expenses if I choose premium options?

Final Word!

Is cataract surgery covered by insurance? In most cases, yes, especially when it's deemed medically necessary to restore vision. However, coverage details can vary depending on your insurance provider, the type of intraocular lens used, and whether you're on Medicare or a private plan. To avoid unexpected costs, it's important to review your policy, obtain prior authorization if required, and confirm coverage with your eye care provider in advance. Taking these steps ensures you receive the care you need with clarity and confidence.

Need help navigating insurance and finding trusted eye care providers? Envoy Health connects you with vetted clinics, transparent pricing, and personalized support for procedures such as cataract surgery, both domestically and abroad. Sign up with Envoy Health and take the first step toward affordable, expert-led care.

References

Disclaimer

The information in this article is for educational purposes only and does not replace medical advice. Always consult your doctor before starting any treatments.

The federally sponsored Medicare coverage for cataract surgery applies to individuals aged 65 years and above.

LASIK eye surgery is generally not covered by insurance, as it is considered elective. LASIK reshapes the cornea and ensures clear vision. However, it is a corrective surgery, an alternative to the non-surgical prescription glasses or contact lenses. For this reason, most insurance plans do not cover LASIK. One can plan for employee-sponsored benefits, such as an FSA or HSA, or take advantage of provider-offered discounts or payment plans to help manage the high costs associated with healthcare.

Corrective eye surgeries, also known as refractive eye surgeries, eliminate the reliance on prescription glasses. Most insurance companies do not offer coverage, considering them an updated version of the non-surgical alternative.

Cataract surgery is considered a medically necessary surgical procedure, and insurance plans such as Medicare and Medicaid typically cover up to 80% of the costs. Additionally, private insurance plans, including Aetna, Cigna, Blue Shield, and Blue Cross, also cover cataract surgery when it is medically necessary. However, most insurance plans cover only the surgery along with a standard IOL.

The cost of cataract surgery in the US ranges between $3,000 and $7,000 per eye. The exact price varies with the provider, the technology used, the type of IOL, and insurance coverage.

The state-sponsored Medicare and Medicaid are ideal for cataract surgery if you fall into the eligible category. Private insurance companies, such as Cigna Health Insurance, Aetna, and Humana, also offer better coverage; however, copays and deductibles vary depending on the plan you choose.

So, we partner with the premier healthcare facilities!

Send me the list